Pioneer Global Blockchain Bond Stirs ‘Huge Interest’

A branch office of the Commonwealth Bank of Australia in Sydney, April 2, 2015 (Photo by Maksym Kozlenko) By Sunny Lewis SYDNEY, Australia, September 11, 2018 (Maximpact.com News) – Using the Commonwealth Bank of Australia as arranger, the World Bank has launched the world’s first bond to be created, allocated, transferred and managed through its life […]

Sustainable Finance European Style

At the European Financial Forum 2018 in Dublin, Ireland, Commissioner Valdis Dombrovskis first row center, Raquel Lucas, of Commissioner Dombrovskis’ team, on the left, and on the right, Gerry Kiely, who heads the European Commission in Dublin. Feb. 1, 2018 (Photo courtesy European Commission) Posted for media use. By Sunny Lewis BRUSSELS, Belgium, January 31, […]

Private Transport Sector Embraces Climate Action

Young people at COP22 in Marrakech, Morocco will live with the consequences of the decisions made there. (Photo by UNFCCC) Posted for media use. By Sunny Lewis MARRAKECH, Morocco, November 15, 2016 (Maximpact.com News) – Sustainable transport leaders from the private sector met at the UN Climate Change Conference in Marrakech (COP22) on Saturday for […]

Recycled Polyester Challenge Draws Global Fashion Brands

Garment workers cut cloth to pattern sizes at a clothing factory in Faisalabad, Punjab, Pakistan, March 3, 2020 (Photo by Adam Cohn) Creative Commons license via Flickr BONN, Germany, May 10, 2021 (Maximpact.com News) – Competitive fashion industry executives from throughout the world convened by the UN Climate Change agency have reached a consensus. They […]

Brutal Weather Hits Extremes

Smoke from fires burning in British Columbia, Canada. Colin Seftor, an atmospheric scientist based at NASA’s Goddard Space Flight Center, has published data maps collected by the Ozone Mapping Profiler Suite that show the smoke reaching as far as the U.S. Midwest and northern Quebec. July 18, 2017 (Image courtesy NASA) Public domain. By Sunny […]

Spotlight Deal: Composting Adds Value for Mali Farmers

In the rural areas of some developing countries, bio-waste is a problem and so is the degradation of arable land through soil erosion and moisture loss. A new deal on the Maximpact platform offers a solution to both of these challenges for farm communities in rural Mali. Working with the Malian government, Transcarbon, a consulting […]

China’s Multi-Trillion Dollar ‘Belt and Road’

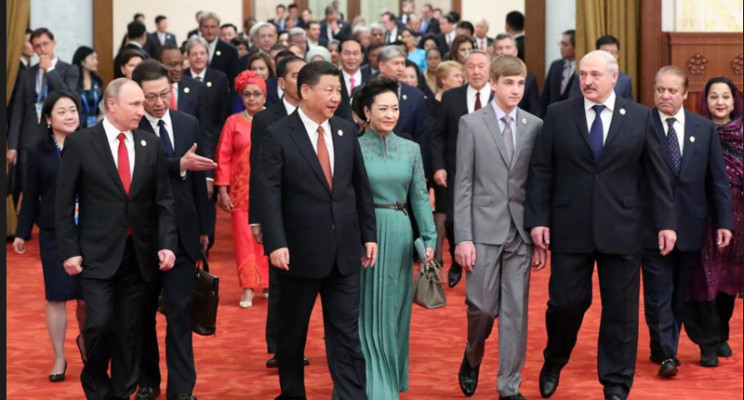

Chinese President Xi Jinping, and his wife Peng Liyuan, accompany their guests, including Russian President Vladimir Putin, left, to a welcome banquet at the Belt and Road Forum for International Cooperation, Beijing, China, May 14, 2017. (Photo by Liu Weibing courtesy Xinhua) State media By Sunny Lewis BEIJING, China, May 16, 2017 (Maximpact.com News) – […]

U.S. Airlifts Thousands From Kabul to a Future Unknown

A group of Taliban fighters in a government office in Kabul, Afghanistan, the day they took control of the country, August 15, 2021. (Photo by Daniel Moskowitz) Public domain By Sunny Lewis for Maximpact WASHINGTON, DC, August 25, 2021 (Maximpact.com Sustainability News) – Every day, the United States is moving thousands of people out of […]

Myths vs. the reality about refugees

What do you think of when you hear the word ‘refugee’? Are your thoughts positive? Negative? Completely indifferent? In countries that host refugees, public sentiment towards migrants tends to be overwhelmingly negative, based largely on misunderstandings and myths. The results of a 2018 survey undertaken by the University of Cyprus Center For Field Studies (UCFS) […]

Are you compliant with the European Energy Efficiency Directive Article 8?

The deadline for Article 8 compliancy is nearing, and the time to act is now if you want to avoid incurring penalties. Will you be compliant by December 2019? Here is all you need to know about Article 8, and how to take the first step towards becoming Article 8 compliant. What is the Energy […]

Why the Impact Sector Needs New Legal Structures: Guru Arthur Wood Talks to Maximpact

Arthur Wood,social finance pioneer and founder of Total Impact Advisors, is an impact sector leader with new legal structures in his sights. A former banker with years on the financial “dark side” (as he calls it) Wood left banking to become the head of social financial services at Ashoka. Today he’s back in the private […]

Jumping In to Remove Dams Across Europe

Hučava River weir being removed, 2020, (Photo © WWF) Posted for media use. By Sunny Lewis for Maximpact (Sustainable Solutions Provider) VIENNA, Austria, August 17, 2021 (Maximpact.com | sustainable solutions news) – Citizens from across Europe have jumped together to crowdfund removal of dams on a range of rivers across the continent. The 2021 edition […]